The Future of Viking Therapeutics

My opinions after Obesity Week - November 1st to 4th

Viking Therapeutics (NASDAQ VKTX) is a clinical-stage biotechnology company focused on developing metabolic drugs.

I have covered VKTX extensively on my LinkedIn. If you are not familiar with the company, VKTX has four main drugs in the pipeline: VK2735 SubQ (Obesity / T2D), VK2735 Oral (Obesity / T2D), VK2809 (NASH), VK0214 (X-ALD).

VKTX 0.00%↑ achieved a 26-week high of ~ $81.02 and a low of ~ $47.22. As of 11/12, VKTX 0.00%↑ is being traded at $58.02.

What will give companies a lasting competitive advantage in both the injectable and oral GLP-1 markets?

Greater weight loss

Lower AE

Small molecules that can be mass-manufactured

Major Bull Thesis:

VK2735Oral have best-in-class potential

VK2735 SubQ and Oral can be marketed as a treatment regimen for patients

Losing weight with SubQ

Maintain weight with Oral

Obesity is a > $100 billion market

VKTX could be acquired.

During Obesity Week from November 1-4, many biotech companies gave exciting updates on their weight loss drugs. In particular, VKTX gave an update on VK2735 Oral.

This graphic shows Body Weight Loss Percent Change for different doses of VK2735.

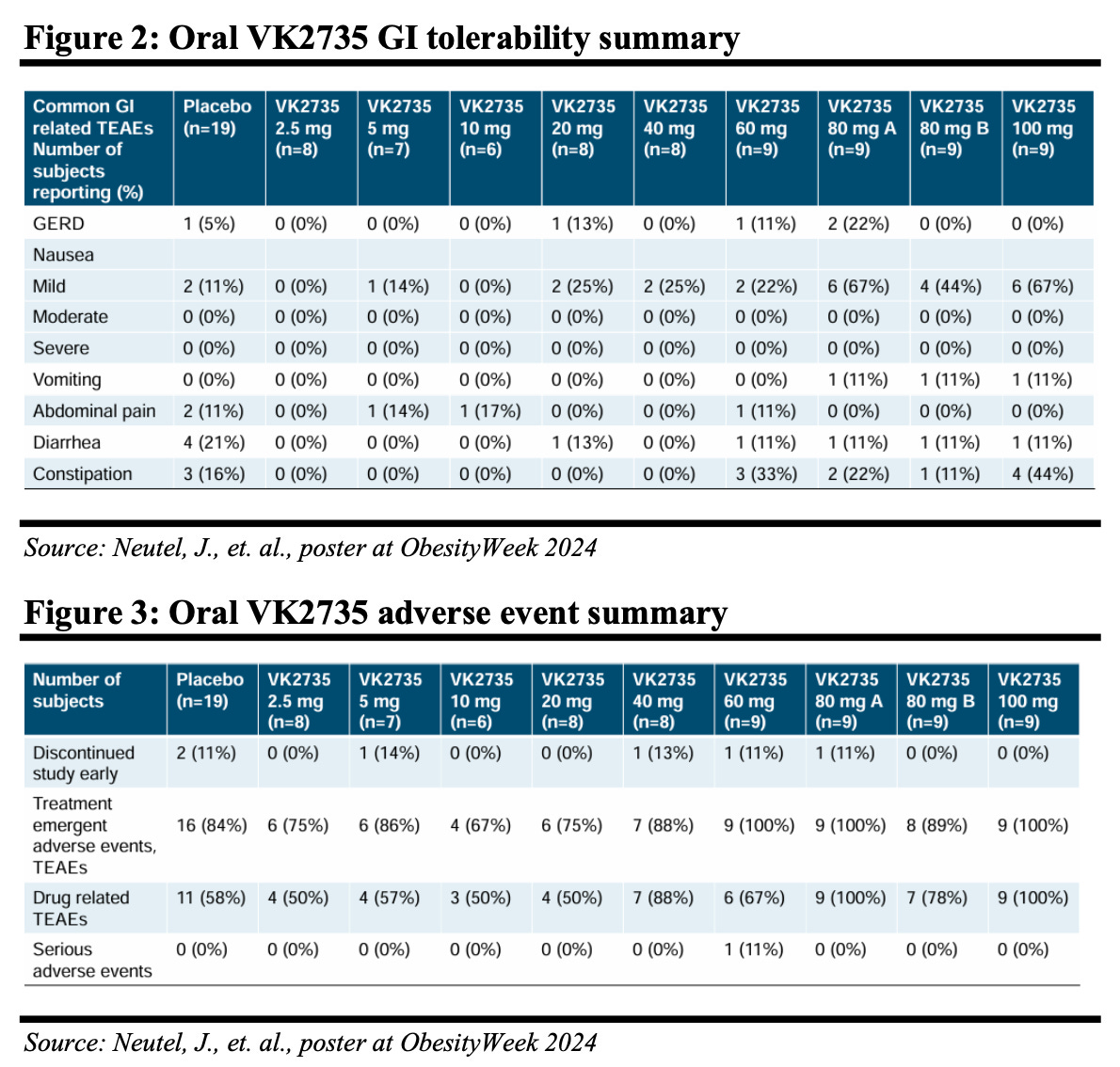

This graphic shows the GI Tolerability and Adverse Events of VK2735.

This graphic compares VK2735 to competitors.

All these data points look great…

So why did the stock not go up?

A few months ago, a colleague of mine was very bullish on VKTX. He asked me why I hadn’t invested more. Looking back, I realized I had a feeling that I only now can pinpoint with hindsight - the fear of disappointment.

VK2735 is one of the most promising drugs on the market in any indication.

Therefore, VKTX is being traded at a premium. Investor expectations are high going into obesity week. So, when they saw VK2735 had best-in-class potential, they expected that. In other words, best-in-class potential was already priced in. The upside potential was already accounted for, so there was only downside potential going into Obesity Week. Some analysts think the stock is overweight for the phase of clinical trial.

With a market cap of ~ $6 billion, VKTX is being traded at a premium for the drug’s clinical stages.

I was nervous to invest more because if Obesity Week had led to even a slightly bad readout, it likely would have caused an overreaction sell-off. That fear of downside potential is the reason why there was a major runup and then a sell-off before obesity week.

Looking at the chart, I believe we are in a price manipulation / sell-off. During obesity week from November 1-4, VKTX 0.00%↑ was trading ~ $74 / 75$. Interestingly, the stock jumped the week before from $60.56 on October 23 to $81.55 on October 28th. ICT PO3 suggests we could be approaching a price manipulation period where institutional investors are selling off to trigger retail stop losses so that institutional investors can enter again at a lower more attractive price.

Major Bear Thesis:

VKTX will not be acquired

VKTX does not have manufacturing capabilities

VKTX drug is not best-in-class and/or will fail clinical trials

Small molecules that can be mass-manufactured

J.P. Morgan analysts predict oral GLP-1 drugs will make up 25% of the entire GLP-1 market. If Oral 2735 captures ~10% of the U.S. oral market, it could generate ~$1.3bn+ in revenue by 2035E.

Oral 2735 is a peptide formulation, which is more challenging and less efficient to manufacture than traditional small molecules since oral peptides require a higher concentration of Active Pharmaceutical Ingredient (API).

While Oral 2735 may be the 4th or 5th oral drug to market—behind competitors like Eli Lilly and Company, Structure Therapeutics, and Pfizer—it’s the only GLP-1/GIP dual-indicator drug showing highly competitive early signs of weight loss and best-in-class potential for AEs.

Novo Nordisk, after completing Phase 3 for its high-dose oral peptide semaglutide, has stated they are not in a rush to launch, as they are prioritizing API for other products in their pipeline.

LLY is developing Orforglipron, an oral small-molecule GLP-1 drug. NVO is developing CagriSema, which targets the gut like Wegovy but also amylin, which targets the pancreas. Amylin’s API is reported to be more effective and easier to synthesize than GLP’s.

M&A / Buy Out

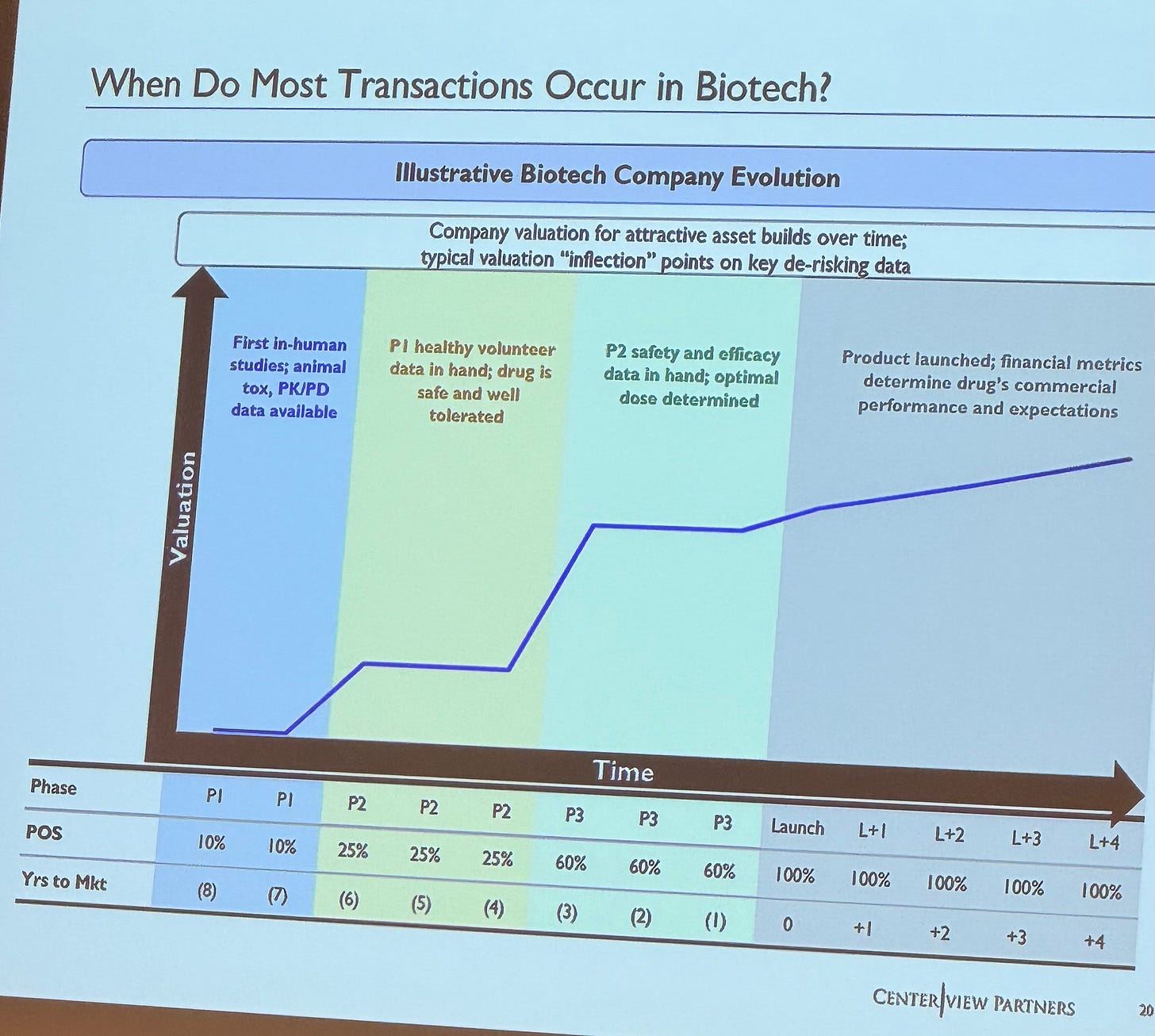

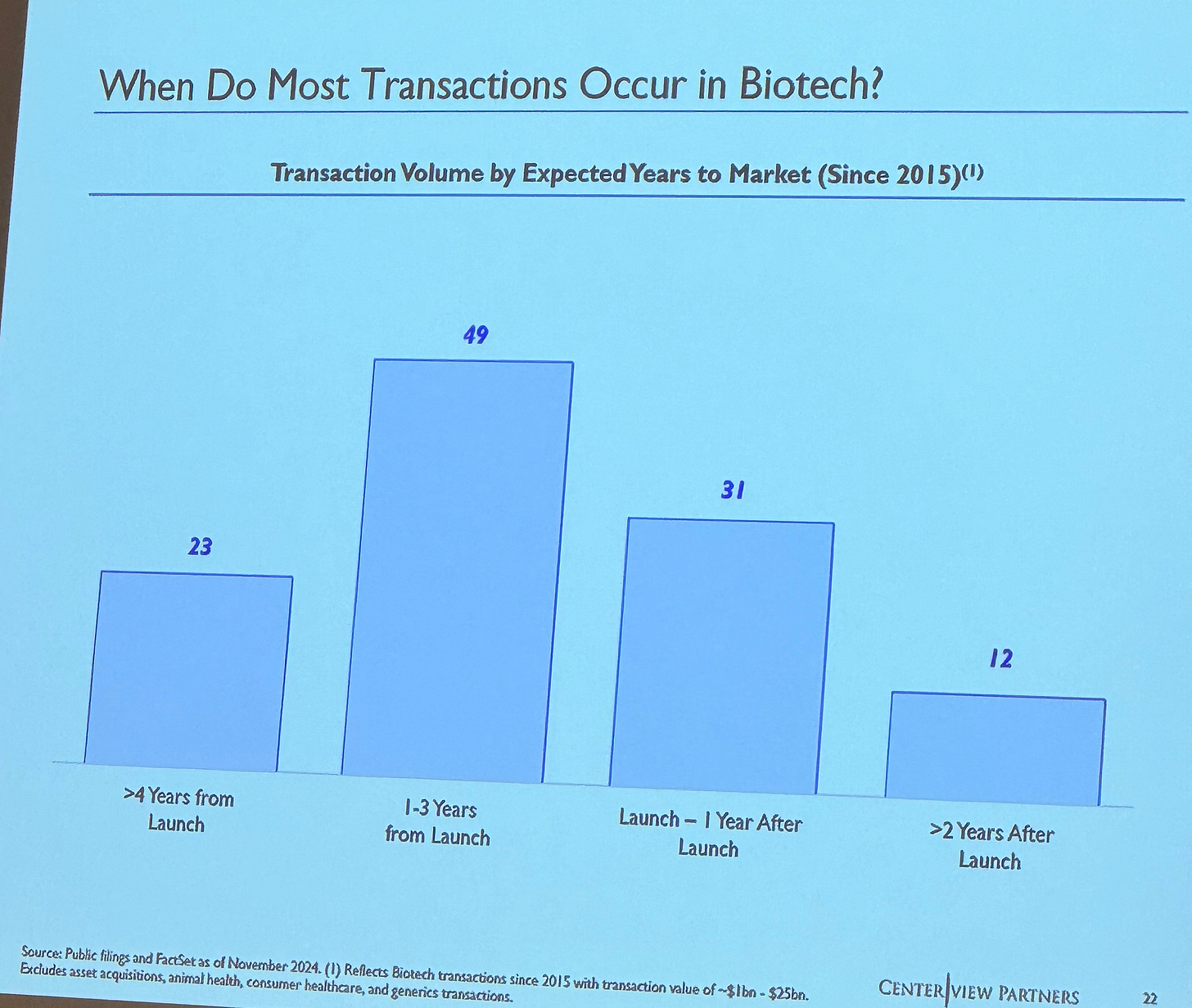

Recently, I discussed the biotech M&A environment with individuals at Centerview Partners.

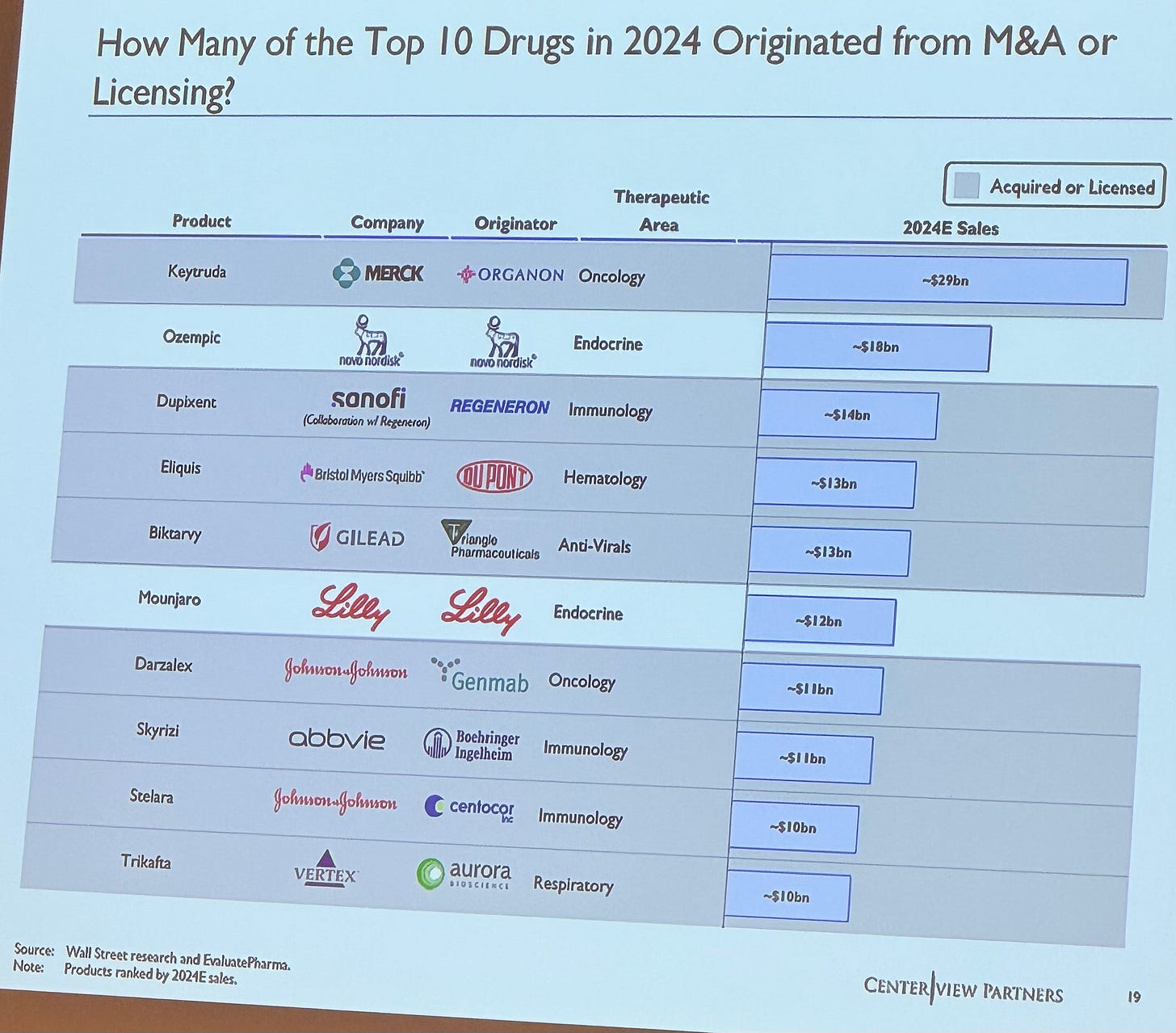

Only two of the top ten drugs selling drugs in 2024 originated from internal R&D, both of which are GLP-1 drugs.

During Covid-19, a majority of big pharma companies made key acquisitions. Why?

Replace lost revenue from patent expires

Diversification into new therapeutic areas

Synergies across a key disease area

However, such key acquisitions have also led to failures. Novartis lost $2.9 billion on their MorphoSys bet. J&J lost on their $5 billion blatter cancer drug. AbbVie lost $8.7 billion of Cerevel Therapeutics.

I believe we will not see many > $5 billion acquisitions next year in pharma. The reason is that many big pharmaceutical companies with said capabilities have already made their acquisitions, of which several have failed.

With most key acquisitions occurring 1-3 years from launch, promising assets like VK2735 that will certainly be bought at a premium will likely get purchased once they reach stage three trials.

Notable names who could acquire VK2735 include Pfizer (PFE), Amgen (AMGN), and Merck (MRK).

Contract Development and Manufacturing Organization (CDMO)

VKTX could likely partner with a CDMO company to manufacture the API in VK2735 Oral and SubQ.

Moreover, VKTX could partner with SHL Medical or Ypsomed, which are the two largest suppliers of autoinjector manufacturers in the world. Autoinjectors are currently the standard option for delivering SubQ GLP-1. Ypsomed recently stated they have 31 deals with companies developing GLP-1s.

However, VKTX will still need to spend millions on marketing to advertise the drug to patients. Moreover, VKTX will have to employ a massive sales force team of drug representatives to educate doctors on the use cases of VK2735. This would be a massive uphill battle against pharmaceutical giants like LLY and NVO who are selling household-name GLP-1 drugs such as Ozempic and Wegovy.

Moreover, I am curious to see if the BioSecure Act of 2024 will have any effects on the CDMO environment in the future.

Capital Expenditure (CapEx) Investment:

VKTX currently has ~ $900 million in cash on its balance sheet. They could certainly invest in manufacturing capabilities. However, I believe this is the least likely outcome because this does not solve the marketing/sales problem - however, there is still a chance of this happening. On November 7th, the Federal Reserve decided to “lower the target range for the federal funds rate by 1/4 percentage point to 4-1/2 to 4-3/4 percent”

I believe that is a bullish sign for the future of VKTX if they ever need to raise or borrow capital.

Partnerships

I believe it is likely that VKTX will pursue a strategic partnership with a household big pharma name to manufacture, market, and sell the drug. This outcome would lead to a positive outcome for both VKTX and its partnership company. Moreover, a partnership would allow VKTX to build its name and cash holdings, allowing it to pursue other promising drugs in its pipeline like VK2809 and VK0214.

Here is the link to an article I helped write that explains more:

My Play

My mentor told me to “let your future hindsight become your current foresight.”

I did not buy before Obesity Week because I did not want to tie my capital in at such a high valuation. However, after Obesity Week when the valuation went back down, I bought post readout. Buying after the readout allowed me to de-risk a bad readout possibility. When I saw the great news and the shares were fairly priced, I bought more of VKTX.

I am 90% confident VKTX will receive FDA approved for either VK2735 SubQ or Oral.

Here is a video where I dive into the Discounted Cash Flow Model I created for VKTX

Link to VKTX DCF:

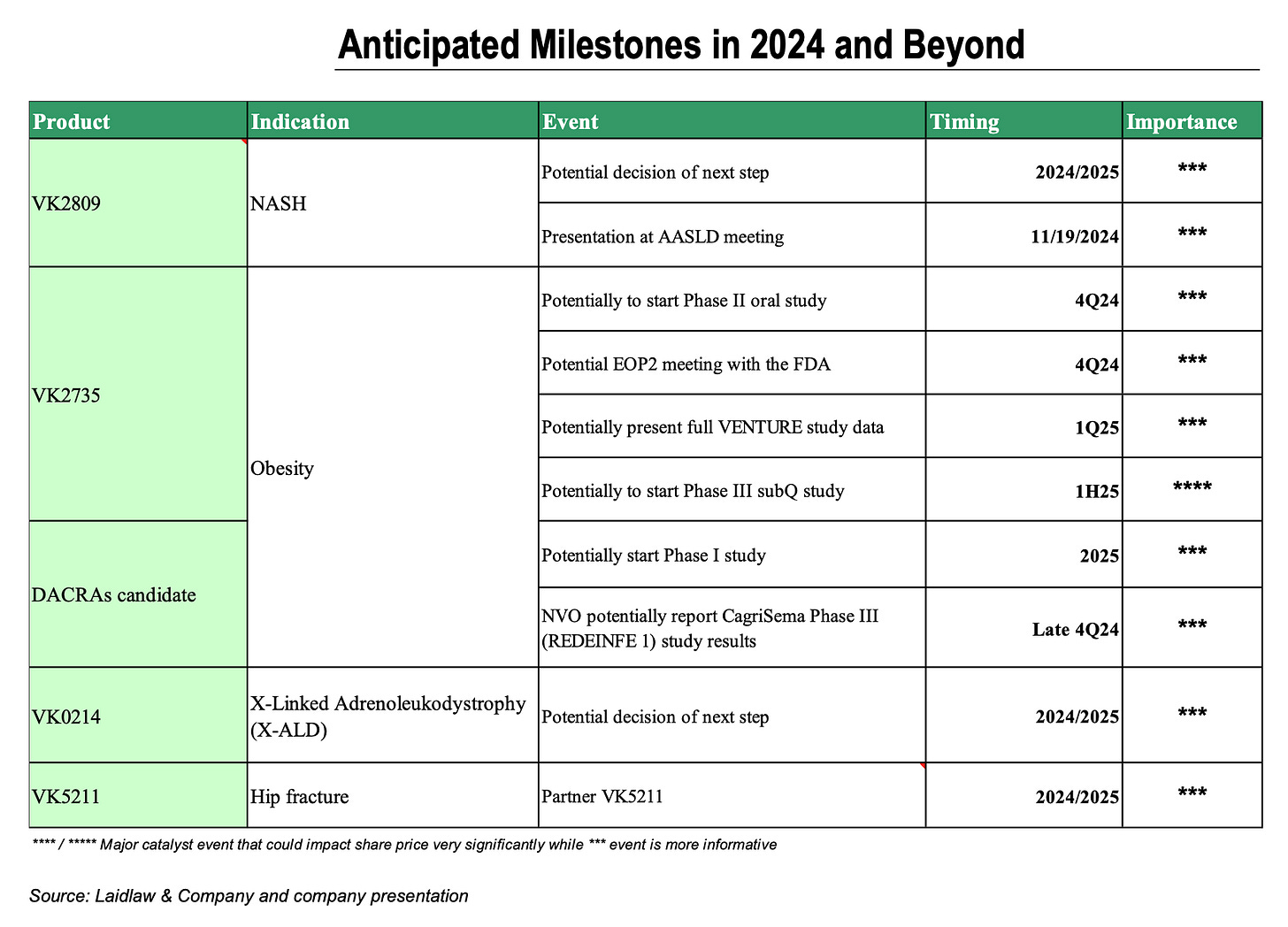

Here is a list of key milestones for the future of VKTX.